Form 1120 Excel Template Fill Online, Printable 2021

Understanding the Form 1120

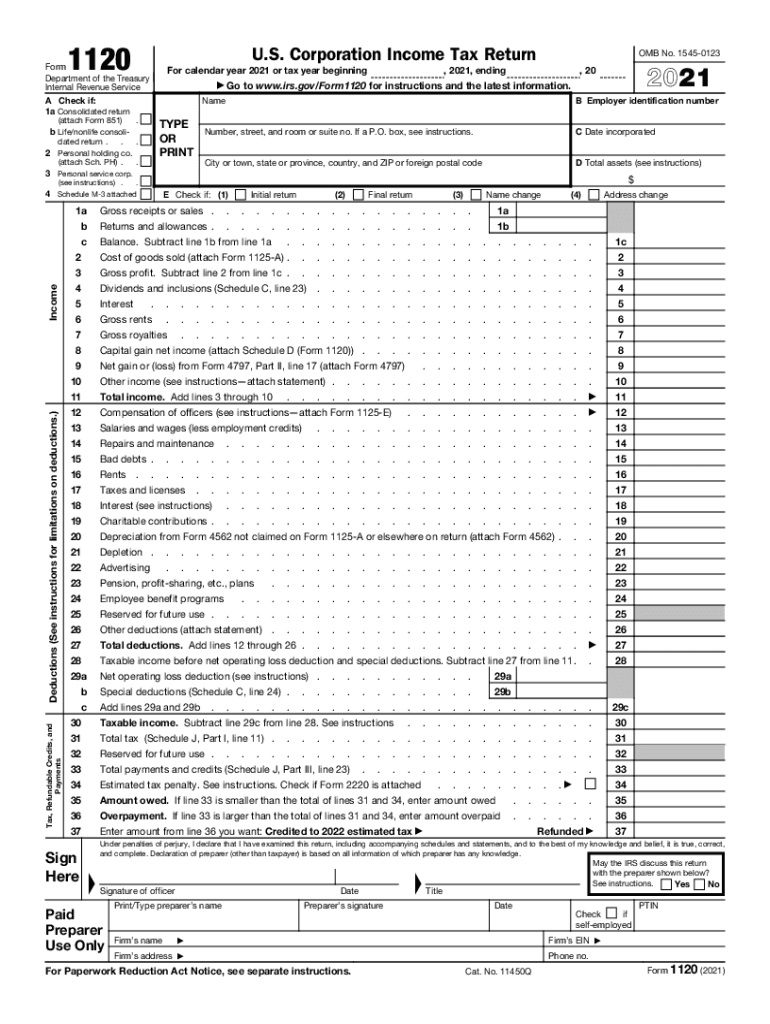

The Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporate tax compliance and is filed annually with the Internal Revenue Service (IRS). It captures a corporation's financial activities over the tax year, allowing the IRS to assess the corporation's tax liability. The form requires detailed financial information, including revenue, expenses, and tax credits, which helps determine the total taxable income.

Steps to Complete the Form 1120

Completing the Form 1120 involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary financial documents, such as income statements and balance sheets. Next, follow these steps:

- Fill out the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report total income on Line 1, including gross receipts and any other income sources.

- Deduct allowable business expenses on Lines 2 through 20, which may include salaries, rent, and other operational costs.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the tax computation on Line 31 to determine the tax owed.

- Sign and date the form, ensuring that it is filed by the deadline.

IRS Guidelines for Form 1120

The IRS provides specific guidelines for completing and submitting Form 1120. These guidelines include instructions on what information must be reported, how to calculate taxable income, and the necessary signatures required for submission. Corporations must ensure they follow these guidelines to avoid penalties. The IRS updates these guidelines periodically, so it is crucial to refer to the latest instructions available on the IRS website or through official publications.

Filing Deadlines for Form 1120

The deadline for filing Form 1120 is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the due date is April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Corporations can file for an automatic six-month extension, but they must submit Form 7004 to request this extension before the original due date.

Required Documents for Filing Form 1120

When preparing to file Form 1120, corporations need to gather several key documents to support their reported income and deductions. Required documents include:

- Financial statements, including income statements and balance sheets.

- Records of all income sources, such as sales receipts and interest income.

- Documentation of expenses, including invoices and receipts for business-related costs.

- Any applicable tax credits or deductions, such as depreciation schedules.

Penalties for Non-Compliance with Form 1120

Failure to file Form 1120 on time or accurately can result in significant penalties. The IRS may impose a penalty for late filing, which is typically calculated based on the number of months the return is late. Additionally, inaccuracies in reporting income or deductions may lead to further penalties and interest on unpaid taxes. It is important for corporations to ensure compliance with all filing requirements to avoid these financial repercussions.

Quick guide on how to complete form 1120 excel template fill online printable

Complete Form 1120 Excel Template Fill Online, Printable seamlessly on any device

Digital document management has become increasingly prevalent among organizations and individuals. It offers an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage Form 1120 Excel Template Fill Online, Printable on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to modify and eSign Form 1120 Excel Template Fill Online, Printable effortlessly

- Find Form 1120 Excel Template Fill Online, Printable and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that functionality.

- Create your eSignature using the Sign tool, which takes just moments and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 1120 Excel Template Fill Online, Printable and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1120 excel template fill online printable

Create this form in 5 minutes!

How to create an eSignature for the form 1120 excel template fill online printable

How to create an e-signature for your PDF file online

How to create an e-signature for your PDF file in Google Chrome

The best way to make an e-signature for signing PDFs in Gmail

How to generate an e-signature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an e-signature for a PDF on Android devices

People also ask

-

How can airSlate SignNow help with my tax return process?

airSlate SignNow streamlines the tax return process by allowing you to easily send, sign, and manage all necessary documents electronically. This not only speeds up the submission of your tax return but also minimizes the chance of errors. With a user-friendly interface, handling your tax return forms becomes straightforward and efficient.

-

What features does airSlate SignNow offer for managing tax return documents?

airSlate SignNow provides a variety of features tailored for tax return management, including customizable templates, auto-fill options, and eSignature capabilities. You can securely store and organize all your tax return documents in one place, making it easy to access them anytime. This helps maintain compliance and ensures your tax return documents are always up to date.

-

Is there a free trial available for airSlate SignNow for tax return needs?

Yes, airSlate SignNow offers a free trial that allows you to explore its features for your tax return process. This trial gives you firsthand experience with sending and signing documents electronically without any commitment. You can assess how airSlate SignNow simplifies your tax return management during this period.

-

How much does airSlate SignNow cost for handling my tax return documents?

airSlate SignNow provides several pricing plans that cater to different business needs, making it a cost-effective solution for managing tax return documents. The pricing is transparent and based on features, ensuring you only pay for what you use. By using airSlate SignNow, you can signNowly reduce the costs associated with traditional paper-based processing of tax returns.

-

Can I integrate airSlate SignNow with my accounting software for tax returns?

Absolutely! airSlate SignNow seamlessly integrates with various accounting and tax software, streamlining the process of managing your tax return documents. This integration simplifies data transfer and improves accuracy, allowing you to focus more on your business rather than paperwork. Ensuring all your tax return data is synchronized enhances efficiency and reduces errors.

-

What security measures does airSlate SignNow have for tax return documents?

Security is a top priority at airSlate SignNow, especially when it comes to sensitive tax return documents. We employ advanced encryption methods and secure data storage solutions to protect your information during transmission and storage. This means you can confidently manage your tax return processes without worrying about unauthorized access.

-

How do eSignatures work with my tax return forms in airSlate SignNow?

eSignatures in airSlate SignNow are legally binding and ensure that your tax return forms are signed quickly and securely. When you send your tax return documents for signature, recipients can sign them electronically, which speeds up the process signNowly. The platform also keeps a detailed audit trail, giving you peace of mind about the legitimacy of your tax return submissions.

Get more for Form 1120 Excel Template Fill Online, Printable

- Letter from landlord to tenant returning security deposit less deductions hawaii form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return hawaii form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return hawaii form

- Letter from tenant to landlord containing request for permission to sublease hawaii form

- Hawaii sublease form

- Hawaii landlord tenant form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable hawaii form

- Hi lease form

Find out other Form 1120 Excel Template Fill Online, Printable

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy